Last time I emphasized getting specific on your revenue streams — down to the customer segment, pricing model, and customer lifetime assumptions.

In this post, I will show you how to use these simple inputs to ballpark your business model and test whether it’s worth pursuing.

If you don’t have a “big enough” problem worth solving (that’s not even plausible on paper), then why expend any effort on it.

The traditional top-down approach for doing this is attaching your business model to a “large enough” customer segment. Then the logic goes that if you can capture “just 1%” of this large market, you’ll be all set.

After all, 1% of a billion-dollar market is still a lot of zeros…

The problems with this approach are that

- it gives you a false sense of comfort,

- it doesn’t address how to get to this 1% market share with your specific product, and finally

- 1% market share might not even be the right success criteria for you.

For these reasons, I advocate a different approach.

Before you can test whether your business model is worth pursuing, you must first ballpark the finished story benefit of your business model.

“If you don’t know where you are going, any road will get you there.”

- Lewis Carroll, Alice in Wonderland

I know this sounds a lot like the “exit question” investors ask, and I can already sense your uneasiness. Most people hate this question because it feels like arbitrarily picking yet another large number out of thin air (like a $100M exit goal) and then working excel magic to rationalize the number.

First, this number isn’t quite pulled out of thin air.

We need this number to justify the business model story — first to ourselves and then to our internal and external stakeholders (team, investors, budget gatekeepers, etc.).

$100M represents a return on investment a VC needs to justify its investment across a portfolio of highly risky startups. That said, this number doesn’t have to be $100M and is more a function of your business model incubation environment.

If you were exploring a new business model in an enterprise setting instead of a startup, there would similarly be some expected return (one with many zeros, too) to justify the effort expended.

Even as a solo bootstrapper, you probably have (and if not, should have) some ballpark numbers to justify your return on effort per project. This could very well be a $100M exit, but could just as well also be generating an extra $1,000/mo of passive income.

There is no right or wrong answer but you should have an answer.

I’ll warn you that this can be a deep (and often uncomfortable) thought exercise that gets to your personal “why.” Still, the constraints it exposes allow for a more actionable strategy.

And that’s the more important message:

While we all need a ballpark destination to justify the journey, it’s not the destination itself but the starting assumptions and milestones along the way that inform whether we are on the right path or need a course-correction.

.

.

Read on to see how to make this number more actionable…

1. Determine your Minimum Success Criteria

Instead of thinking about your business model’s maximum upside potential (like the 1% market share goal), I find it more helpful to think in terms of timeboxed minimum success criteria.

If, for instance, you had asked the Google or Facebook founders when they were first starting whether they thought they would go on to build billion-dollar companies, they would probably have laughed at you.

“We built it and we didn’t expect it to be a company,

we were just building this because we thought it was awesome.”

- Mark Zuckerberg

In the case of Google, we know that despite building a very successful search engine (in terms of usage), they struggled for years to find a sustainable business model and even tried to sell themselves to Yahoo for $1M, which got turned down. So then, we could say that their minimum success criteria morphed from whatever it started at to $1M. That didn’t keep the google founders from going on to build a billion-dollar company.

No one penalizes you for revising your goal upwards.

Not only is the minimum success criteria easier to estimate than your maximum upside potential, but it also helps you model your progress along the way.

Your minimum success criteria is the smallest outcome that would deem the project a success for you X years from now.

Some notes:

1. I like to use X as three years and don’t recommend going over five years.

The key is picking a time box just far enough into the future that allows you to demonstrate a small-scale working version of your business model.

2. I prefer framing the outcome as a yearly revenue number versus profit or a company valuation.

Yearly revenue has fewer inputs which keep the model simple. The others are optimized derivations of revenue. So as long as you leave yourself enough room, you should be okay.

3. Finally, the outcome does NOT have to be revenue based.

For instance, I wasn’t driven to write my book, Running Lean, by money but impact. Not-for-profit ventures also fall into this category which I’ll cover in a future post.

.

.

That said, the minimum success criteria is just a number, and it’s still somewhat decoupled from the actual specifics of your business model.

Let's see how we tie the two together.

2. Convert your Minimum Success Criteria to a Customer Throughput Number

While money or revenue is easy to measure, money is a terrible measure of progress for a business model.

Here’s why:

Revenue is generally a longer customer lifecycle event

Relying solely on revenue as the measure of progress can mean flying blind for a long time. Even if you are already generating revenue, unless you can tie back revenue to specific actions or events from the past, you can easily mislead yourself.

For instance, it’s common to see everyone in the company taking credit during a good quarter and pointing fingers during a bad quarter.

Revenue can be gamed

The danger with using money as the measure of progress is that it’s tempting to resort to accounting tricks, strategies, and policies that, while good for short-term cash flow, may actually be detrimental to the overall long-term health of your business model.

For example, it may be tempting to license your technology to a bigger company or do some custom development on the side. But if these don’t represent repeatable actions in your business model, they may be one-off cash flow events that distract you from building a scalable model.

.

.

The answer to the problems above is deconstructing your revenue goal into its constituent customer throughput metrics.

While revenue can be gamed, it’s harder to game customer behavior.

We can model customer behavior using the sub-steps from the customer factory diagram below:

You’ll see that while revenue is one of these metrics, other metrics come before revenue. These metrics, like retention/engagement, can serve as leading indicators for revenue and are more effectively used as a measure progress.

Additionally, by tying back revenue to these leading customer behavior metrics, you avoid the short-term gaming and accounting tricks from earlier.

These leading indicators, by the way, also hold the key to modeling multi-sided business models that I’ll cover next time.

But for now, let's keep this simple and see how we can use the simple inputs from your Lean Canvas combined with your minimum success criteria to test whether you have a business model worth pursuing.

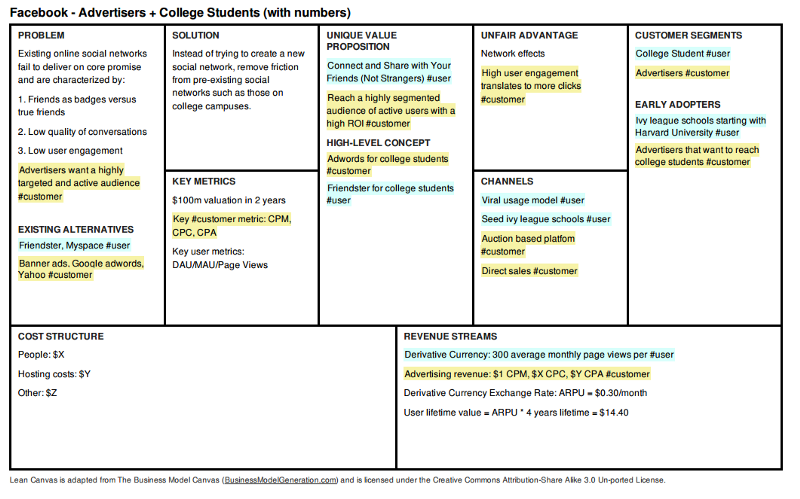

Consider the following Lean Canvas from one of my software products:

The critical inputs I need from the Lean Canvas are:

Goal = $10M/yr revenue

LTV = $200/mo * 2 years = $4,800

The first number I need to calculate is the customer throughput or production rate that I will need to sustain my model at scale. In other words, I will treat the customer factory as a black box for now and only focus on its output.

I want to know how many customers I need to continually produce (on the right) to sustain my $10M/yr revenue goal.

Here’s the simple math to do this:

Make sure you work the numbers out for yourself before moving on…

In my workshops, people have no problem calculating the number of active customers needed for $10M/yr revenue, which in this case, works out to 4,167 active customers. But the 2,083 new customers/yr isn’t the number of active customers but the number of new customers you need to create in your business model every year to replace older customers that leave due to churn.

Later we’ll model the internals of the customer factory, but this output customer production rate is enough to serve as your first dose of reality for your business model.

3. Test/Refine Your Business Model Against Your Minimum Success Criteria

The purpose of this simple back-of-the-envelope calculation is to turn a big fuzzy revenue number into something real and tangible — like creating customers.

All metrics are people first.

It’s much easier to do a gut test with people than just with numbers. You can now revisit your Lean Canvas and put your customer segment and channel assumptions to the test.

- How does having to add ~2,000 new customers every year make you feel?

- Is your customer segment big enough?

- Do you have any scalable channels identified already for building a significant enough path to customers?

The business model above targets SaaS companies as early adopters and more general software companies as the total addressable market at scale. So for me, the 2000 customer production rate doesn’t immediately freak me out.

During a workshop in Paris, however, I ran through a similar exercise with an entrepreneur who intended on charging €5/mo for his product with a 2-year projected customer lifetime and a €5M/yr revenue goal.

Here the math worked out to adding 40,000+ new customers every year!

This simple math invalidated his model because there weren’t even that many potential customers in all of France.

The solution to this problem is pretty straightforward.

First, you might try growing your customer segment. We had a short discussion on market size. The entrepreneur was already contemplating expansion to other countries. Those plans would need to be accelerated if nothing else was done.

The other options for lowering your required customer production rate are obvious from the formula:

You can either lower your yearly revenue target or raise your customer lifetime value.

Assuming we don’t want to lower our yearly revenue target (just yet), the way you increase your customer lifetime value is either by increasing your customer life term or raising prices.

1. Increasing your customer life term

Doubling your customer life term from 2 years to 4 years would half your customer product rate. That said, increasing customer life term is non-trivial because it potentially requires you to revamp your value proposition and product.

2. Raising prices

This is by far the most powerful (and underutilized) lever you have in your business model. Doubling pricing from €5/mo to €10/mo also cuts the required customer production rate in half. But unlike increasing life terms, a price change may only take a few minutes to implement on your checkout page.

Sure, there is always the danger that increasing pricing will result in fewer customers, but what if it doesn’t?

If you could double your pricing, and not lose more than half your customers, you still come out ahead.

I’ll get into why in a future post.

Isn’t this all just funny math anyway?

At this point, you might be wondering whether all this is even worth the trouble. After all, you can easily double or quadruple the pricing model on paper to make the model work. So what?

Let’s go back to this statement from earlier:

While we all need a ballpark destination to justify the journey, it’s not the destination itself but the starting assumptions and milestones along the way that inform whether we are on the right path or need a course-correction.

We started with a big fuzzy money goal (the destination) and first converted it into a customer throughput number. We then further deconstructed this number into a set of input parameters (starting assumptions) that can actually be measured from day one.

While quadrupling your price might have been easy on paper, if you can’t get outside the building and find ten people that will accept that price (first milestone), then you have a problem!

You don’t need three years to figure this out.

Getting accurate customer lifetime value numbers requires more time. But here also, you can begin to extrapolate customer lifetime value using secondary approximations (like your monthly churn rate). You don’t have to wait for the full customer lifetime to estimate your customer lifetime value.

Like scientists, our job as entrepreneurs is first to build a model and then test that model through experiments.

If the experiment fails, we need to either adjust the model or, more likely, adjust the input assumptions into that model.

“It doesn’t matter how beautiful your theory is, it doesn’t matter how smart you are. If it doesn’t agree with experiment, it’s wrong.”

- Richard P. Feynman

CLICK HERE to download the Lean Canvas poster(preferred by thousands of entrepreneurs)