Lean emerged from the manufacturing world with a rallying cry for “waste reduction” in the production process. Lean Software drew parallels between hardware and software manufacturing processes and aimed to reduce waste also in the production process.

Then Lean Startup came along and pointed out that efficient production is NOT enough UNLESS it also delivers customer value and emphasized learning OVER production towards that end.

In a startup (or any new product) where you don’t yet know whether what you produce will generate customer value, you are better served by limiting or completely forgoing production (through an MVP or concierge MVP, for example) to first test value creation.

You must first find a problem worth solving before committing resources to build and scale a solution. This is the essence of what I teach in my bootcamps where I have a “no code rule” and teach how to forgo such production completely until the right time. That said, while I’ve always found this logic highly rational, it’s often a hard pill to swallow for entrepreneurs because we love production and optimizing production processes.

I also couldn’t help feeling that the full impact of all that lean thinking offers is left deferred to the latter stages when customer value production is in full tilt (After Product/Market Fit).

Then I had a mini-epiphany.

All Entrepreneurs Are in the Manufacturing Business

It occurred to me that all entrepreneurs are also in the manufacturing business, but what we manufacture isn’t limited to our products.

Entrepreneurs build systems to manufacture happy customers and the business model is a blueprint of that system.

Happy customers get you paid, and doing this repeatedly and efficiently at scale (i.e., building a business model that works) is the goal of a startup.

The Happy Customer Manufacturing Process

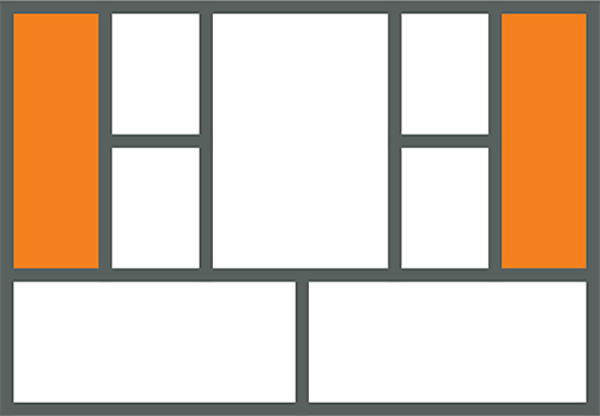

This is a high-level block diagram of the manufacturing process that makes this happen:

Most of you should recognize this as Dave McClure’s Pirate Metrics. It captures the macro-steps that define the customer lifecycle or funnel.

Your job is to build a system that can repeatedly take unaware visitors as raw materials and convert enough of them into happy customers.

The marketers among you might already see this as obvious since you already think in terms of a funnel. But the manufacturing metaphor opens the door to several lean and systems-level thinking, which may not be as obvious — such as applying the theory of constraints in concert with the concept of customer pull from lean to avoid pre-mature and local optimization traps.

I’ll get into these latter-stage applications in subsequent posts. Still, today I’d like to share how this systems thinking metaphor can be used to tame even the earliest and often the fuzziest stage of a product — finding Problem/Solution Fit.

Why Finding Problem/Solution Fit is Hard?

Most learning during the Problem/Solution Fit stage comes through customer interviews. Because this kind of learning is typically qualitative (versus quantitative), it’s often regarded as learning that is “too soft” or “intangible.”

This makes entrepreneurs nervous and skeptical.

Here’s a sampling of questions I often hear:

* How many interviews should I run?

* How should I score interviews?

* How can interviewing just 20 people be statistically significant?

* How do I know when to stop?

* What if I don’t learn anything useful?

Others conflate customer interviews with more traditional customer research and offer prescriptive advice like:

* Don’t lead prospects

* Listen to customers

* Keep clear of cognitive biases like an observer, selection, and confirmation biases

* Run surveys and focus groups on collecting as much information as possible

The end result: Entrepreneurs view customers interviews as

* DIFFICULT TO DO

* A TIME SINK

* NON-ACTIONABLE

I don’t blame them.

I felt exactly the same way when I started.

Everyone pays lip service to talk to customers but talking alone is not enough. It’s a recipe for amassing tons of (maybe) interesting but otherwise non-actionable information (trivia).

Done correctly, though, customer interviews are the fastest way to learn.

But you have to be goal driven.

THE FIX: Apply Systems Thinking

PRINCIPLE 1:

Problem/Solution Fit is a scaled-down version of Product/Market Fit

The goal of the Problem/Solution Fit stage isn’t learning for learning’s sake.

The output isn’t a 100-page customer research report but rather a repeatable system for acquiring and activating “just enough” customers for Stage 2.

In other words, the Problem/Solution Fit stage is fundamentally about building the same repeatable customer funnel only at a smaller scale and with different elements:

* using interviews in place of scalable customer acquisition channels

* using a demo in place of a working product for activation

* using appropriate payment commitments in place of actual revenue

* getting permission to follow up (retention), and

* getting referrals to other prospects

The key here (as with any funnel) is repeatability.

Want to sell your solution to doctors? Can you set up and run five interviews in a week? Maybe you start by calling close friends for intros. Can you then take the learning from those interviews to line up another 5 (how about 10) interviews the following week? If not, seriously reconsider your channels and maybe even your customer segment.

If you can’t repeatedly activate your target customers at a small scale using direct channels and f2f interviews, what makes you think you can do this using indirect or self-serve channels (like the web) at a much larger scale?

Many people ask me how long Problem/Solution Fit takes because they can’t wait to be done with customer interviewing. I have to burst their bubble by telling them that building a continuous customer feedback loop never really ends. Sure some of the tactics evolve for scale, but the process doesn’t get easier.

PRINCIPLE 2:

Always focus on the macro (aka don’t miss the forest for the trees)

Lean measures what customers do, not what they say they’ll do.

Customer actions are the only macro metrics that matter.

Everything else is a means to that end (a sub-funnel made up of micro metrics).

At the macro level, the interview is a black box designed to convert prospects into customers.

What goes into it is irrelevant, provided you stay focused on the macro and don’t fall into the local optimization trap.

For example, it is tempting to use aggressive discounting or give away your product to get early customers only to find out later that they weren’t the right customers. You always have to view the system as a long funnel.

On a more practical level, though, what goes into the interview black box does matter. In my book, I describe a rather prescriptive structure to these interviews. This structure was built through field-testing hundreds of customer interviews, and it was designed to maximize speed/learning as measured by moving prospects down the funnel.

That said, my structure is only as prescriptive as any other best practice, like, say, for example, building an effective landing page. We know the use of elements like headlines, social-proof, etc., work, but people still deviate from these guidelines all the time — as they should (I do too).

At the end of the day, use the structure that repeatedly delivers on your macro metric.

People also tend to over-think the “purity” of their interviewing process and liken it more to 3rd party research. In my book (pun not intended), Customer Interviews are NOT the same as Customer Research.

Each has a different goal:

* Customer Research is for hypotheses generation, while

* Customer Interviews are for hypotheses validation.

We all have some level of cognitive biases, but it’s not as bad as it’s worked out to be. In fact, in certain instances, it’s even helpful or required.

Let’s look at how working business models look at scale.

- You build a direct sales force because your customers prefer to buy from humans. This is required observer-effect at play.

- You build dozens of landing pages and corresponding campaigns to deeply segment your customers. This is selection bias at work.

Sure there is always the danger of your biases leading you down the wrong way. For example, a series of confirmation biases can make you believe you have a killer product on your hands because you selected a subset of the data that supports this.

All data in aggregate is “crap”.

- Avinash Kaushik

There is nothing wrong with this, provided the subset shares a common pattern that isn’t shared with the others — maybe you are honing in on a more narrow definition of your early adopter. Can you identify this common pattern and then repeat the observed effect at will?

Sure, when dealing with any bias, you have to be cautious, but I don’t believe the solution is avoiding bias altogether. But rather testing them through multi-faceted exploration (e.g., subtle 5 Whys during the interview) and ultimately measuring the macro.

It is better to be specific and wrong than vague and right.

PRINCIPLE 3:

You are done when you can demonstrate a 90% confidence interval

There is a great book by Douglas Hubbard titled: “How to Measure Anything” where he shows you how to measure things that are seemingly intangible or uncertain by first framing them around more tangible ranges and then applying a 90% confidence interval test.

Yes, customer interviews are qualitative, and learning can seem intangible, but when you frame it around the macro goal, it all becomes very measurable.

You start the interviewing process by casting a wide net of potential customers. Your initial interviews may result in a 20% success rate. Over time, as you refine both your early adopter definition and problem understanding, you should yield higher success rates.

This learning is subsequently used to create a compelling offer made up of your solution (demo), unique value proposition, and pricing (Solution Interview). This is where the rubber hits the road.

When you can repeatedly convert qualified prospects into customers with a 90% confidence interval, you have achieved Problem/Solution Fit and are ready to move on to stage 2.

For my latest product, USERcycle, I interviewed close to a hundred companies ranging from pre-launch to enterprise software companies (casting a wide net). Through these interviews, I honed in on my early adopters as SaaS companies with some early traction. I then crafted three qualifying questions to identify these early adopters and built a specific offer for them (demo + starting price).

I knew I had reached a Problem/Solution fit when I could with near certainty predict, from just the answers to those three questions, whether the prospect would agree to the interview, find the demo compelling, and sign-up for a $200/mo starting plan.

What’s Next

I found thinking of the business model as a system and the manufacturing metaphor particularly empowering for visualizing the three staged journeys of startups.

What did you think? I’ve got more actionable doodling like this one in the works…