The key takeaway from my last post was that the “business model” is the real product of a startup.

As entrepreneurs, we’ve got the solution covered but need help with the rest of the business model to avoid chasing after solutions no one cares about, which is a form of waste.

Startup As Conversations

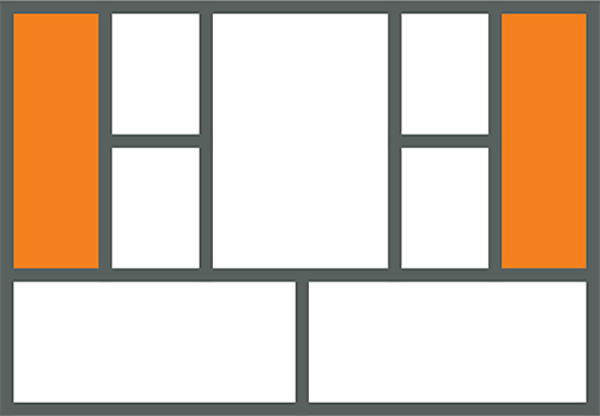

You build your startup through a series of conversations with other people that complement your worldview — advisors, customers, partners, investors, and even competitors.

“Customers don’t care about your solution.

They care about their problems.”

- Dave McClure , 500 Startups

Customer Development is a conversation where customers complement your worldview on Problem and Solution. Validating you have a problem worth solving (Problem/Solution Fit) is one of the riskier parts of the model you need to tackle early.

Right Action, Right Time

Too often, though, entrepreneurs engage in the wrong conversation at the wrong time, which also leads to waste. Like talking to investors before customers, prematurely seeking distribution partners, or paying too much attention to competitors.

Investors don’t care about your solution or your customers.

They care about the scalability of your business model.

The stage of your startup largely drives the order of these conversations. Before Product/Market Fit, the focus should be centered on learning. During this stage, I find it most productive to surround myself with customers and advisors.

After Product/Market Fit, the focus then shifts to growth. That’s when you stand to reap the biggest impact with investors and partners — especially if you’re converting them from existing customers and/or advisors.

Customer Discovery can still lead to waste

I used to advocate jumping right into customer interviews after “Step 1: Document your Plan A,” but customers don’t always have all the answers, or finding the answers can take too long. Remember, they mostly care about their problems.

While I agree that Customer Discovery should be among the first conversations to initiate, prematurely jumping into customer interviews can still lead to waste for the following reasons:

1. There are many possible Customer Segments to tackle

For a given problem/solution, there may be many possible customer segments, each representing different business models with varying suitability, given your unique perspective and resources.

One of my earlier products, BoxCloud, was built around solving a large file sharing problem. This could easily have been targeted at graphic designers, accountants, lawyers, doctors, architects, etc. Each of these could be a startup of its own. One approach to vetting early models is taking a broad sweep first, but that still takes time to do, and time is your most valuable asset.

2. Waiting is the biggest source of waste

Apart from the time it takes to conduct the actual interviews, much time is spent finding prospects and coordinating these interviews. The biggest contributor to waste during this stage is simply waiting for scheduling responses.

Tip: Consider outsourcing interview scheduling and batching them together.

3. Qualitative learning is not perfect

Ironically, qualitative feedback is most effective when it’s overwhelmingly negative. A strong negative signal indicates that your assumptions most likely won’t work and lets you quickly abandon or refine them. If five out of 5 customers tell you they don’t have a problem, that’s pretty significant!

On the other hand, a strong positive signal doesn’t necessarily mean it will scale or that the customer isn’t lying. All it does is permit you to move forward until that can be verified later through quantitative data.

However, most of the learning during this stage falls somewhere in the middle.

When following a Customer Discovery process, it’s quite possible to interview 30–50 people, get a strong must-have problem signal, build an MVP, refine the first user experience, even get some happy paying customers, and still hit a wall because you can’t effectively reach more customers after that. This is one of the fallacies I described in one of my earlier posts which was a case of not prioritizing channel risk sooner.

While Customer Discovery can help you build the right solution for a given customer segment, you may not be addressing other risks in your model.

Business Model Discovery

Many of these problems can be alleviated by adding another step before Customer Discovery. Rather than jumping into customer interviews, which can take about 4–10 weeks to complete, I now spend a little more time brainstorming and prioritizing the best “possible models” with advisors first — a process I’ll fittingly call “Business Model Discovery.”

I use the term advisor rather loosely. An early advisor might be a prototypical customer/entrepreneur, potential investor, another entrepreneur, or even your spouse or significant other. Even though these models are a collection of untested assumptions, they should at least “work on paper” and be something you can clearly articulate to someone (anyone) other than yourself.

Reasonably smart people can rationalize anything but entrepreneurs are especially gifted at this.

Unlike Customer Discovery, where you systematically start testing parts of the business model — notably Problems and Customer Segments, Business Model Discovery is about tackling the entire business model. The goal of both is learning and not pitching.

The first objective is to take a reality check on your possible models. After I declared to follow a Lean Startup/Customer Development process with my last product, CloudFire, I spent a day filling out the first three hypotheses worksheets at the end of Steve Blank’s book. I then sat down to review them with my wife, Sasha, who was also going to be customer #1. I scheduled only an hour because I had anticipated breezing through these worksheets. It took us 2 hours to get through the first worksheet.

What seemed obvious to me represented “leaps of faith” that weren’t obvious to her. Worse, I had nothing to back them up other than “I just know them to be true.” You need someone on your side who isn’t afraid to call bullshit.

Beyond these early “reality-check” advisors, seek advisors that bring specific perspectives through domain knowledge and/or experience. For instance, before doing any customer interviews on my latest product initiative USERcycle (“KISSmetrics meets MailChimp”), I met with Hiten Shah, Jason Cohen, Joshua Baer, Manuel Rosso, and Eric Ries. Their collective feedback helped inform my decision to pursue a very specific business model over others.

The Goal is Learning

Much like customer interviews aren’t about asking customers what they want, these interviews aren’t about asking advisors what to do.

The Advisor Paradox: Hire advisors for good advice but don’t follow it, apply it.

- Venture Hacks

After documenting your Plan A, Step 2 is identifying the riskiest parts of the model. This is what you need to learn at this stage. We are good at identifying technical risks but need help doing the same with other components of the business model.

The key is not taking this feedback as “judgment or validation” but as a way to identify and prioritize risk. Then move on to Step 3 and tackle that risk through experiments.

Success is unlocked at the intersection of these conversations, and it’s your job as the entrepreneur to synthesize it into a coherent whole.